The world is grappling with a complex web of uncertainties and risks. We asked our key customers, what risks shape their strategy. From the volatile Middle East to the ongoing war of aggression in Ukraine, the uncharted territory of Ungoverned AI, doubts over China's recovery, climate change, and the alarming fight for access to critical minerals. The list seems endless. One way to mitigate risk is by diversifying the strategic project portfolio. Let us take a closer look why that is the case.

Are you interested in learning more about project portfolio management?

Our article "Project Portfolio Management - An Introduction For Practitioners With Little Time On Their Hands" delves deeper into the topic with valuable insights.

In an increasingly interconnected world, the global landscape is fraught with myriad challenges that can potentially shape the future in profound ways. We asked our key customers what risks shape their strategy and how they respond with their strategic project portfolio. This article summarizes the key risks mentioned most often: From climate change to the volatile Middle East, the ongoing war of aggression in Ukraine, the uncharted territory of Ungoverned AI, doubts over China's recovery, and the alarming fight for access to critical minerals, the world is grappling with a complex web of risk and uncertainties that require careful navigation. The little list of global risk factors is anything but conclusive, and it is not the ambition of this article to cover all risk elements at large - notwithstanding, the small list already forms a forceful complex of interdependent factors. They are hard to mitigate, especially at the company level.

Given today’s times, companies, amid strategic planning and goal-setting, have a challenging time making ends meet. One way to mitigate risk on the meta-level is simple hedging, namely by diversifying the strategic project portfolio. When choosing this way forward, the Project Management Office (PMO) must stay on top of things even more than usual. Project Portfolio Management - and hence, amongst other things, project risk management, ensuring that projects align with the broader strategic goals, meet specific requirements, are prioritized accordingly, are delivered in full and on time, and so on - is the game's name. Let’s take a closer look at the risks mentioned and the role of a PMO in these times.

Risk: Climate Change is here

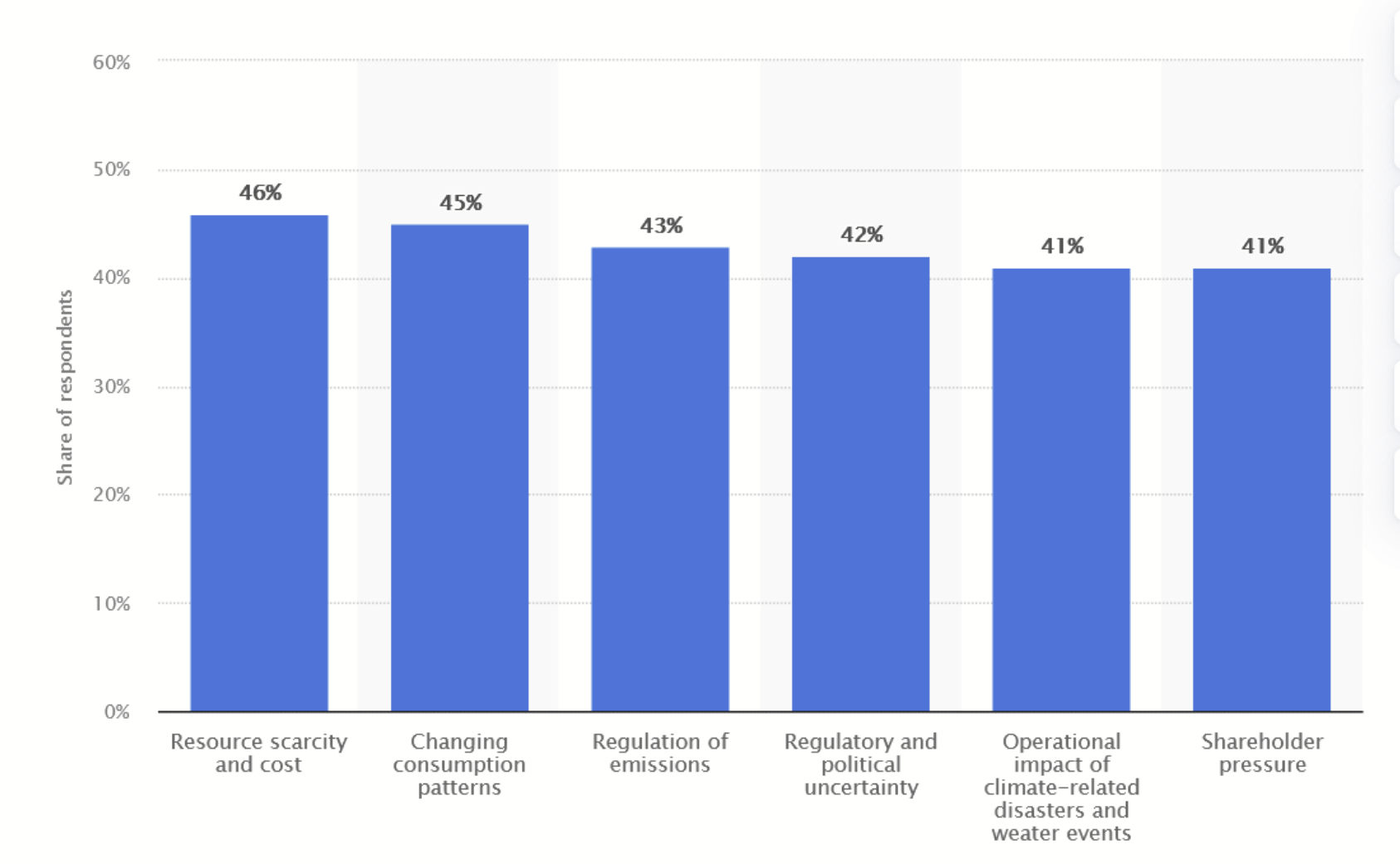

Climate change has profound implications for companies across various sectors. Rising global temperatures, extreme weather events, and shifting climate patterns pose direct and indirect risks to businesses. Companies are confronted with challenges such as supply chain disruptions, increased operational costs due to resource scarcity, and the need to adapt to changing consumer preferences driven by environmental consciousness. Regulatory pressures are also intensifying, with governments worldwide implementing stricter environmental standards. Conversely, there are opportunities for businesses that embrace sustainability, innovate in green technologies, and adapt resilient strategies. Overall, the impacts of climate change on companies encompass financial, operational, and reputational dimensions, emphasizing the imperative for organizations to integrate climate considerations into their long-term strategies.

A global survey conducted between September and October 2022, encompassing over 2,000 C-level executives worldwide, revealed that businesses have already experienced the repercussions of climate change. According to the findings, 46 percent of respondents identified resource scarcity and cost as significant challenges affecting their operations, with changing consumption patterns closely following as a key concern.

Risk: Middle East on the Brink

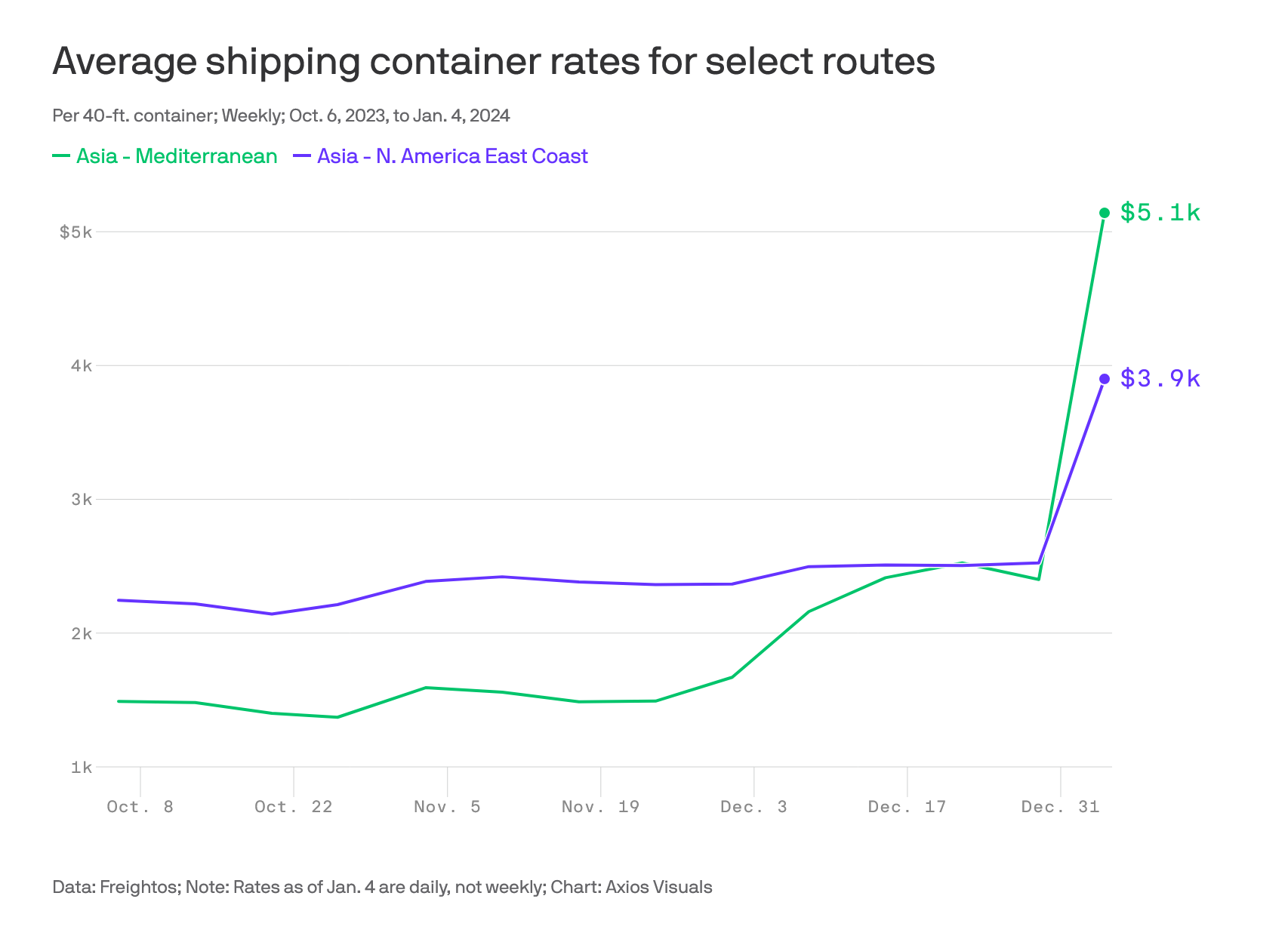

The Middle East has long been a geopolitical hotspot, but current dynamics are intensifying concerns about regional stability. The risk meter is running high. Ongoing conflicts in Syria, Yemen, and Iraq, coupled with the recent Israeli-Palestinian war, create a volatile mix that has far-reaching implications. The influence of external powers and the potential for proxy wars further escalate the situation and horrible humanitarian crisis. The region's stability is crucial for the people living there - losing it has global repercussions, affecting energy markets, migration patterns, and international security.

A very tangible example of this is illustrated with the global trade routes. Many of the world's leading shipping companies have halted navigation through the Red Sea in reaction to Houthi strikes. This has resulted in the paralysis of a vital maritime route responsible for facilitating 12% of the world's trade. The continuous Houthi attacks are expected to maintain heightened freight insurance rates, causing disruptions in global supply chains and contributing to inflationary pressures. Furthermore, as the conflict encroaches upon Iran, there is an increased risk of disturbances to oil flows in both the Red Sea and the Persian Gulf, potentially leading to a surge in crude prices.

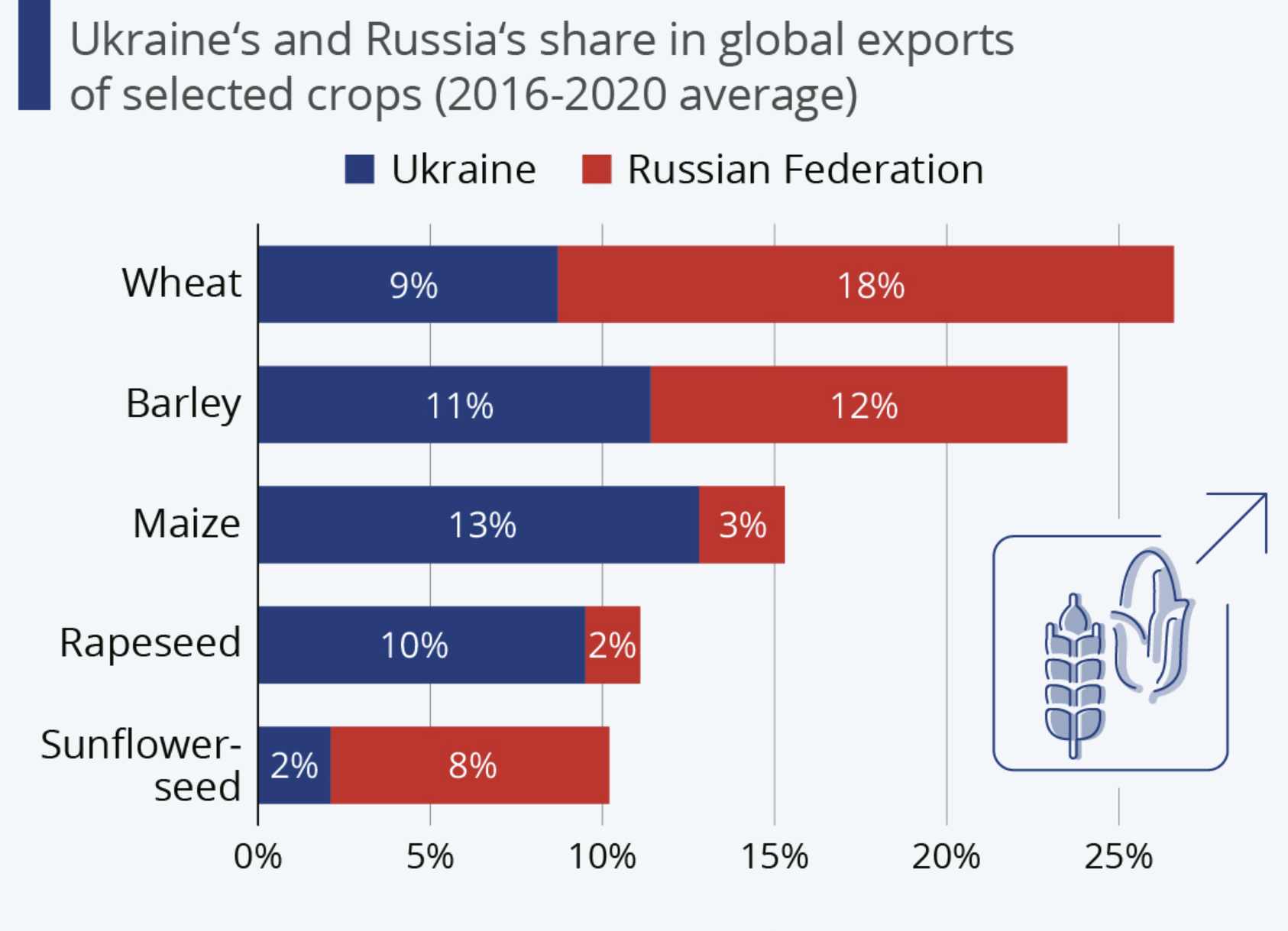

Risk: Ukraine - A Flashpoint in Eastern Europe And Globally

Ukraine remains a focal point in Eastern Europe and the world as such. With the conflict in the eastern regions simmering for years, the annexation of Crimea by Russia in 2014, and the terrible and ongoing war in the Donbas, the situation has found its high point. The risk of a renewed escalation looms large, with potential consequences ranging from an intensification of the humanitarian crises to a broader conflict involving major powers. Finding a diplomatic resolution to the Ukraine crisis remains a pressing global priority. However, a partitioned Ukraine - with seaports such as Sevastopol in Russian occupation - is a possible, if not likely, outcome and risk. Once again, global trade routes and access to parts and resources such as wheat and other agricultural products are affected. Again, this is already happening - gruesomely illustrated in Ukraine’s share in global exports of selected crops.

Risk: Access to critical minerals

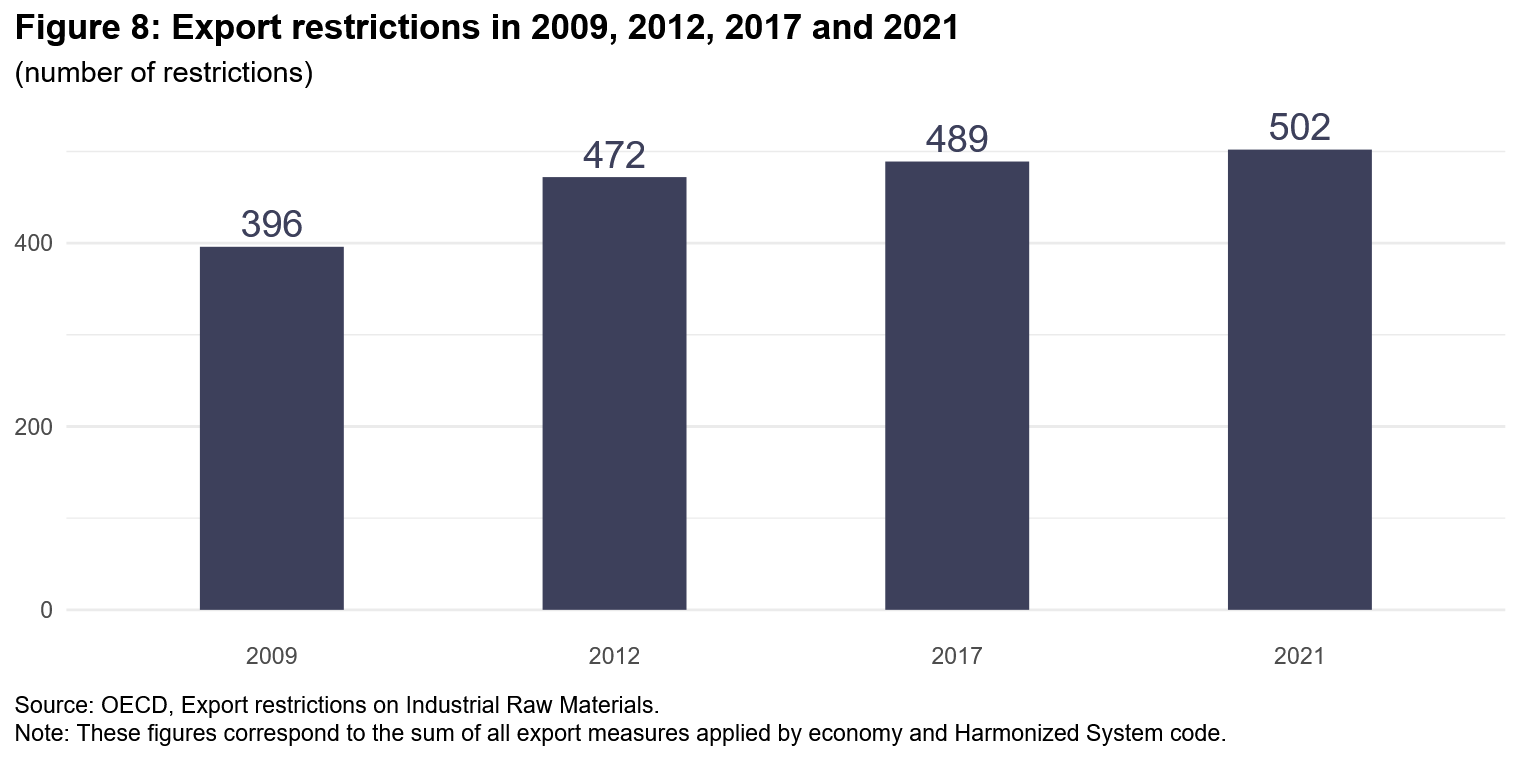

The global fight for access to critical minerals has become a central focus in international geopolitics and economic strategies. As demand for rare earth elements, lithium, and other vital minerals surges due to their crucial role in advanced technologies, renewable energy, and manufacturing, nations are actively vying for control over key mining sites. This competition has geopolitical implications, impacting national security, economic dominance, and technological advancements. The struggle for access to critical minerals underscores the intricate balance between resource scarcity, environmental sustainability, and the pursuit of technological innovation in an increasingly interconnected world. One interesting indicator regarding crucial minerals is export restrictions or export tariffs. They have been on the rise.

These measures have the potential to influence the worldwide supply of critical minerals, leading to increased pressures on global prices. This raises concerns about the security of the supply chain for raw materials to manufacturers, as highlighted in reports from the Organisation for Economic Co-operation and Development (OECD). Given that the access to critical minerals sits upstream to an abundance of products - especially in the high-tech sector - the supply chain (yet again) seems at peril.

Risk: No China Recovery: Global Economic Implications

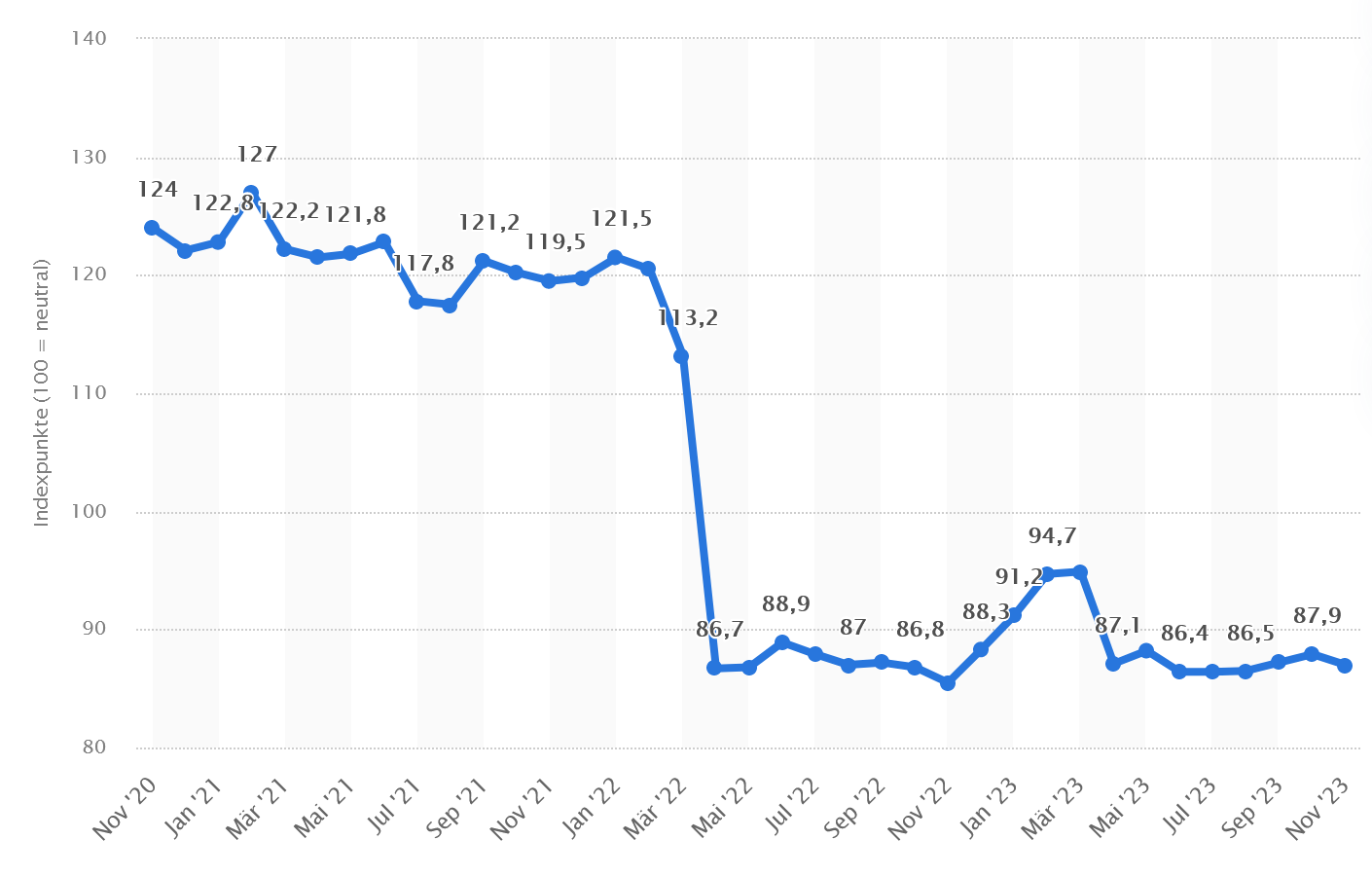

As the world's second-largest economy, China's global economic health has profound implications. Today, China has parted ways with the believed unwaverly growth trajectory it has grown accustomed to. Due to economic slowdowns, debt crises, or other factors, a swift return to the former growth path is at odds. With that, risk extends not only to sourcing parts and materials from China but to sales, too: The Consumer Confidence Index has found its all-time low for the time being.

Risk: Ungoverned AI - A Pandora's Box of Technological Risks

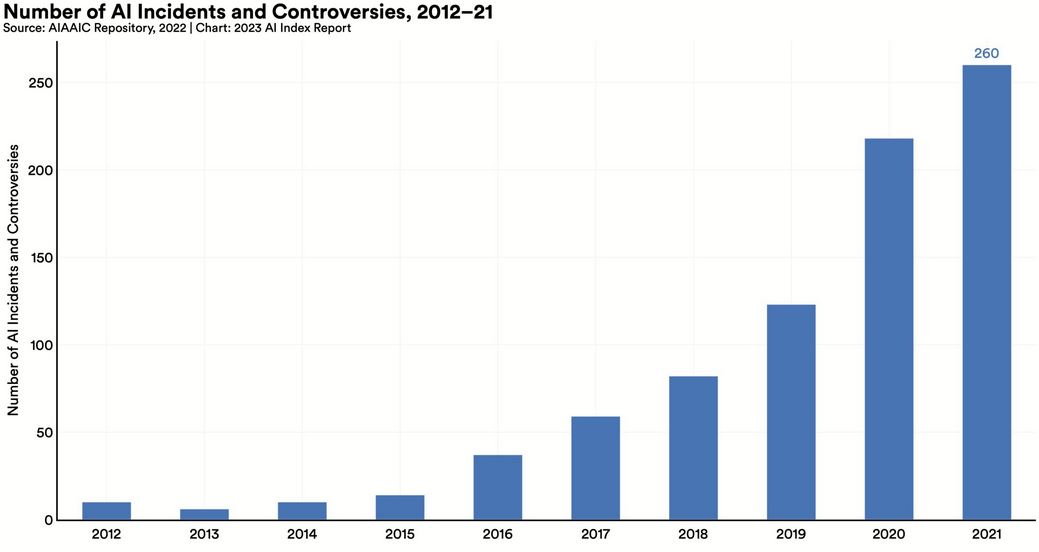

The rapid development of Artificial Intelligence (AI) has outpaced regulatory frameworks, giving rise to concerns about the potential consequences of ungoverned AI. From deepfake technology, and erosion of privacy to the impact on cyber security, the rampant growth of AI poses significant risks. Striking the right balance between innovation and regulation is crucial to harnessing the benefits of AI while mitigating potential harm.

The threat is real and already here. Here is one example: In 2022, U.S. state and federal courts witnessed a surge in AI-related legal cases, reaching a total of 110, approximately seven times the number recorded in 2016. The focal points of these cases were predominantly in California, New York, and Illinois, involving matters pertaining to civil, intellectual property, and contract law.

So… what has this to do with PMOs?

PMOs are asked to prioritize smartly and take action - and if so, very swiftly, if necessary. For one, the risk complex described shows heavy potential to disturb global trade further and potential issues regarding the global supply chain and, hence, access to parts and resources. Mitigation strategies are manifold - but often expensive. For example, companies may look into diversifying suppliers, dual or multi-sourcing, increasing working capital and stock, increasing in-house production, near- instead of offshoring, creating contingency plans, and monitoring geopolitical developments that may impact international trade routes. PMOs need to understand the severity of the situation on the individual company level to such an extent that smart prioritization and swift action are possible. This puts additional pressure on PMOs and the C-Level, too.

Cutting costs and preparing for waters to calm

Our own little study named #SHIFTHAPPENS23 has brought forward quite a few interesting findings. Amongst others, we found that in 2023, German companies often tried to cut costs and refrained from high-risk projects more than in less volatile times - although especially the more risky endeavors were assigned with a higher strategic value. In fact, strategic ambitions - such as business model innovation - were commonly put on hold in favor of projects helping weather the current storm of risks. Especially this kind of swift adaption favors a central unit overseeing the entire project portfolio: the PMO. If you would like to read more about what we found when asking more than 460 German company representatives, feel free to do so here.

The mentioned countermeasures are just examples and do naturally not extend to all risks mentioned. What measures need to be taken and when - if at all - remains to be seen. But this little excursion to the project side of things aims to illustrate a broader point: companies may need to react quickly in times of global uncertainty. Complete transparency on the entire project portfolio is essential to do so at scale. Only then can intelligent prioritization be brought forward. PMOs play a pivotal role in securing full transparency at all times!

That is easier said than done. Several things need to be in place to keep the level of transparency high. For one, suitable software helps. If you want to learn what makes a good Project Portfolio Management Software, feel free to go down the rabbit hole here.